The US Securities and Trade Fee (SEC) has filed a Wells Discover to Immutable over its gross sales of IMX tokens. The SEC’s competition is expounded to a 2021 weblog put up on the pre-launch funding made within the IMX tokens priced at $0.10 or a $10 pre-100:1 cut up.

Immutable has questioned the SEC’s judgment, saying that the worth was inaccurate; thus, the cost is “incorrect” since no trade occurred between events.

Immutable (IMX) was one of many in style gaming-focused tasks in 2021, a time of the rising recognition of play-to-earn (P2E) blockchain tasks. The blockchain venture featured an NFT market and an L2 scaling resolution, primarily serving third-party recreation builders.

Immutable has acquired a Wells discover from the SEC, the most recent of their de facto coverage of regulation by enforcement. We acquired this inside hours of our first ever dialog, on a timeline clearly accelerated to land earlier than an election.

Sadly, tales like this have gotten…

— Immutable (@Immutable) October 31, 2024

Wells Discover Targets ‘Sale Of IMX Tokens’

Immutable is a number one Australian blockchain that launched a $320 million pre-sale. Round 14% of the IMX tokens went to the general public. SEC believes that the identical IMX tokens throughout its launch violated some legal guidelines, therefore the choice to file the discover.

Within the US, corporations and people could obtain a Wells Discover from the company if they’re investigated for potential violations. Immutable instantly responded to the discover, saying that the company was intentionally harsh on start-ups regardless of little proof of wrongdoing.

Upon issuance of the discover, the company contacted the corporate for a dialog. With a Wells discover filed, Immutable could face a lawsuit quickly.

Token Value Dips To One-Month Low

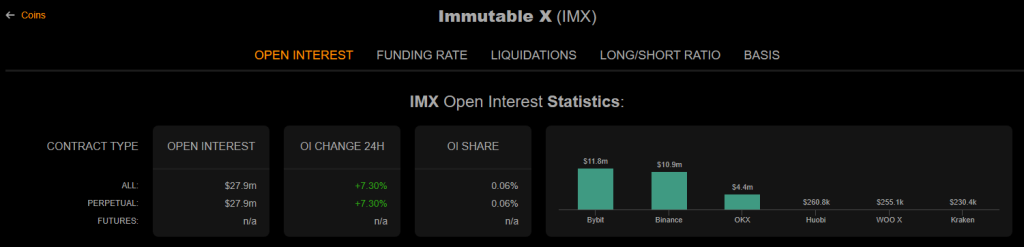

The current information on Immutable and the potential investigation spooked many merchants, pushing the token’s worth to $1.22 from $1.37, a one-month low. Nevertheless, the SEC issuance was additionally useful for the corporate as the amount of its open curiosity elevated. For Immutable, the open curiosity covers coin-margined and stablecoin-margined contracts in USD.

Supply: Coinalyze

Lately, IMX’s open curiosity went from a low of $22 million to a excessive of $27 million in only a few hours. Whereas many contemplate IMX dangerous, analysts see a potential and fast restoration from its lows. High exchanges, together with Coinbase and Binance, carry IMX.

IMX worth down within the final 24 hours. Supply: CoinMarketCap

Immutable Slams SEC For Its Aggressive Enforcement

Australia’s Immutable shared its frustrations over Twitter/X, saying that these notices and investigations have gotten much less stunning. The corporate used the experiences of different blockchain corporations like Coinbase, OpenSea, and Uniswap as examples. Immutable added that the company’s current aggressive strikes now lengthen to gaming.

In the identical put up, the corporate reiterated its dedication to the trade and stated it might proceed constructing to assist gaming. If crucial, the corporate may also combat and defend players’ rights. To date, the SEC’s Wells notices haven’t led to firm or venture delistings, aside from XRP, which was faraway from Binance for one yr.

Featured picture from TechCrunch, chart from TradingView